The year is 1992 – Paul Keating is running the show, Paul Mercurio’s famous knee slide manoeuvre steals hearts in Strictly Ballroom, our home town Broncos win the 85th NRL Premiership under ‘Captain Alfie’ and Aussie kids nationwide meet 2 yellow pieces of fruit dressed in their night time attire – aka Bananas in Pyjamas. Now that you’re all ready for pub trivia – let’s move onto the actual significant event of 1992 that’s related to this blog…

The year brings with it a big moment in the history of retirement planning when the Keating government introduces a 3% mandatory superannuation guarantee (SG). This means most employees can now start to build that all important retirement nest egg in preparation for their future. Fast forward to 2023 where the rate now sits at 11%, and if you are retiring this year, it means your Super balance has been busy compounding and building for over 30 years. If you’ve retired in the last 5 years, more than half of your working life has potentially included superannuation payments as well.

This means that some retirees are “self-funded” – in that your Superannuation account is now your ‘new boss’ paying your ‘retirement wages’ while you caravan the country, however for a large number of people currently retired or about to be, they receive or will be eligible for Centrelink Age Pension support. Centrelink has a habit of occasionally confusing people with updates and changes so we are here to outline them for you as we ‘spring’ towards September.

HOW MUCH PENSION SHOULD I GET?

So, if you currently receive the Centrelink Age Pension, the amount you receive is dependent upon a couple of things:

- if you are a homeowner or non-homeowner (and size of your land)

- the value of your assets and/or income, and

- where your assets/income fall – below the lower threshold or between the lower and the upper threshold.

- If you are a couple or single

If your assets/income are above the upper limits, you will not receive the payment but could still be eligible for the Commonwealth Seniors Health Card.

PAYMENT RATE INCREASE

Generally speaking, the Centrelink Age Pension payment rates are increased in March and September each year, normally around the 20th of the month. It’s not guaranteed though as it’s based on changes to the consumer price index (CPI). Which, if this little acronym baffles you, means a ‘measure of the average change overtime in the prices paid by consumers for a market basket of goods and services.’ We won’t know the details until closer to the date, however in March earlier this year (2023), the pension payment rate increased $37.50/fortnight for a single person and $28.20/per person per fortnight for a couple. This increase has nothing to do with your assets or income, this is purely a “pay rise” if you are eligible.

THRESHOLD INCREASE – WHAT IS IT AND HOW WILL IT AFFECT ME?

Along with a potential change in the payment rate, the threshold limits (ie. ‘goal posts’) will also be reviewed, and if they are increased a few things could happen:

- Some people will become eligible to receive the age pension because they now fall below the upper threshold

- Some people will get an increase in their payment because where they sit on the threshold range has changed, and

- Some people may start to receive the full age pension because their assets/income falls below the lower threshold.

AUTOMATIC UPDATES

The last thing that happens in March and September each year is the automatic update on the values of your assets. This only applies to the assets that Centrelink can receive updates for – like superannuation balances and/or share values. If this update results in an increase in your asset/income value, your Centrelink Age Pension payment could be reduced. Alternatively, if you’ve had a decrease in value, your payment will go up. This can be problematic at times and result in a reduced payment. If you are concerned about this, best practice is to check with your Adviser or Services Australia directly.

*Please note, while Centrelink do receive some automatic updates throughout the year, you are still responsible for letting them know of any changes to your assets or income within 14 days of the change.

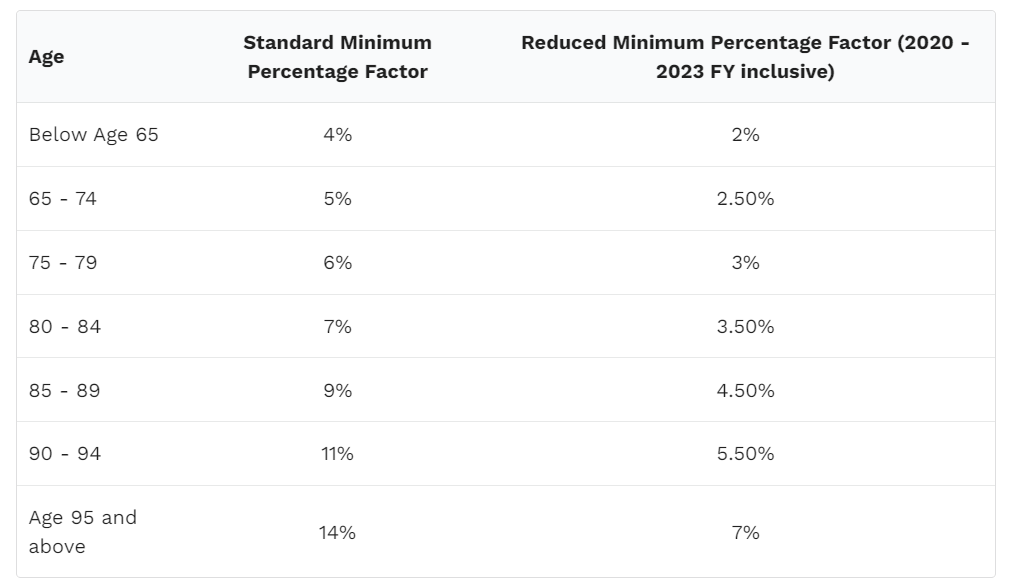

END OF THE COVID DRAWDOWN REDUCTION

It is also important to mention that the minimum amount you are required to withdraw from your super pensions (Pension Drawdown) is no longer receiving the 50% reduction (put in place temporarily during COVID and ended 30th June). For those of you that have been drawing the minimum, this will result in an increase in your regular account-based pension payments – depending on your situation, this could also impact on your Centrelink Age Pension payments.

If you’re eager to learn more about the current income and asset test thresholds, you can read more through the Services Australia information links below:

So in a nutshell – basically you might see some changes in the regular payments you receive from your super pension and your Centrelink Age Pension and there could be a few fortnights where your Centrelink payment changes each time. This is all very normal, even if it feels all over the place! There’s a ‘method to the madness‘ so to speak. However, if you have any questions or concerns, please reach out!

Thanks for reading and enjoy the last few weeks of Winter!