There has been a lot of talk in the media and at the family BBQ about interest rates going up and how this is affecting those pesky mortgage repayments, but increasing rates aren’t just impacting those who have a home loan…Oh yes … here it comes!

For starters, HECS-HELP debts (student loans) don’t accrue interest like other loans. The outstanding balance you owe is indexed each June by the consumer price index (CPI) as a way to maintain its real value. What is this ‘index’ business you ask? Imagine if you borrowed $4 from a friend for a coffee with the intention of paying them back, but you didn’t actually pay them back until a year later. That coffee 12 months on is now valued at $4.50 thanks to a general rise in the cost of living. Your original $4 ‘loan’ (coffee) has had a 12.5% ‘index’ rate applied and you now owe your friend an additional 50c on top of the original loan.

However, had you made a $2 progress payment towards that coffee, meaning at the 12 month mark you only owed $2, the (imaginary) 12.5% index rate would only be applied to the remaining $2 balance therefore you’d only owe an additional 25c instead of 50c.

Furthermore, if you ignored your $4 coffee loan for another ten years, paid nothing down at all, then suddenly remembered you needed to settle your debt, that ‘coffee’ might be worth $6 in ‘real value’ thanks to additional increases in the consumer price index over a decade and suddenly you owe so much more than your original loan.

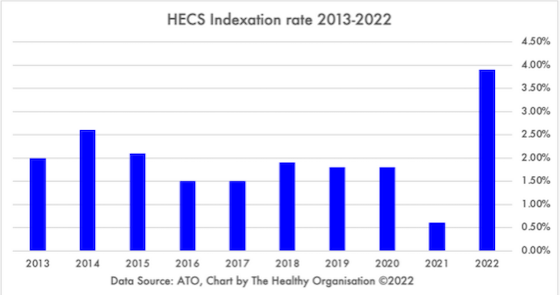

This same ‘concept’ is applied to tertiary education debt. In the past 10 years, the indexation rate has been relatively low, making ‘student loans’ one of the cheapest debts you could get therefore quite attractive to take on. (See Table 1 history below). In Table 1, you can see that if you had an outstanding balance on your HECS-HELP debt of $25,000 in June 2021, your debt would have only increased by $150 at 0.6%, whereas this year, the same debt will increase by $1,775 at the new 7.1% indexation rate.

TABLE 1

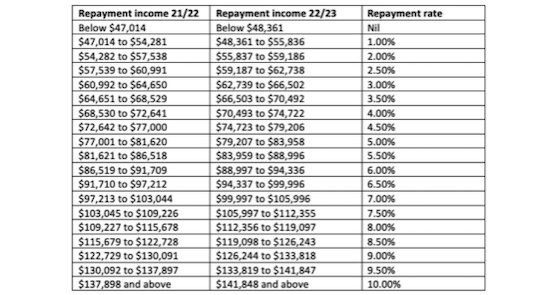

The next piece to this puzzle is how much you are paying off each year (see Table 2). The amount you are required to pay is a percentage of your income and has nothing to do with how much you owe. Therefore, if you earn below $48,361 per year, you aren’t required to pay anything off your debt and even if you are making repayments, you may not be covering the annual increases – meaning the debt just keeps getting higher.

The moral of the story – the sooner you can pay your loan down the more you’ll save in the long run and remember, you can make voluntary repayments at any time.

TABLE 2

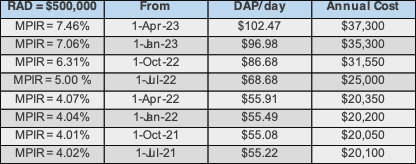

Another area that has been impacted by increasing rates is the Maximum Permissible Interest Rate (MPIR) which is used by Age Care facilities to determine how much ‘daily room rent’ a resident is required to pay. This is commonly referred to as the Daily Accommodation Payment (DAP).

There are lots of variables when talking about Aged Care fees and everyone’s situation is different. Some residents may fall into the category of ‘buying their room’ and this fee is known as the Refundable Accommodation Deposit (RAD) which may cost up to $550,000 or more. If you aren’t able to pay this amount, then the DAP fee is applicable and is calculated as a percentage of the total room fee cost (less anything paid as a deposit) x the Maximum Permissible Interest Rate.

Below is a table showing the MPIR rates since July 2021 and the corresponding daily or annual cost to a resident who is unable to pay a full RAD. From 1.4.2023 it is 7.46% p.a – and this could shortly increase due to the interest rate increases in May and June.

Important to note, the MPIR is calculated on the date of entry, so if you entered care 2 years ago, the rate at that time stands UNLESS you move rooms or facilities as an example. So, if you are already in care and looking to change, be careful.

As you can see, the costs have almost doubled in the last 3 years, making the decision of whether to pay a RAD or a DAP even more important.

So, as you can see, while the ‘hot topics’ that make most of the mainstream media channels tend to focus on mortgage rates quite heavily, there are other situations that deserve equal awareness too.

If this all sounds like gobbledy goop, but you feel you need more information or you are not sure if it impacts your situation or someone you know, feel free to get in touch with us.

Amy Nightingale