One of the very first questions we often get asked is ‘how much will financial advice cost me?’ And our answer is, ‘Would you ask a travel agent how much your holiday will cost before telling them the destination?’ The answer also depends on your own financial destination.

What we can tell you is that there are 2 types of fee structures in the financial advice giving space and I’m going to explain them here.

Clear as mud…or not quite?

What I’ve noticed in recent years when speaking with new clients, is that they are not aware of what financial advice fees they are paying their existing adviser. Oftentimes responding with “Oh, that’s all just done through the product“. Not to say that they have not been informed of what they are paying. However, these things can get a little complicated. Especially when there are so many other things they are likely trying to absorb at the same time.

The answer I would love to hear is – “my financial adviser charges $x per annum OR x% of my account balance per annum in a dollar figure” . As an industry I hope this answer becomes the norm.

Is there a right or wrong way to charge financial advice fees?

Not really, it comes down to preference.

We made a decision many moons ago, to charge based on the amount of work that is required to look after a client for that service period. As such we have a fixed financial advice fee amount per annum.

We believe it is a clear, simple and easy to understand format. It can sometimes be billed through a product (ie. account balance) but oftentimes people prefer to pay via a direct debit from their bank account.

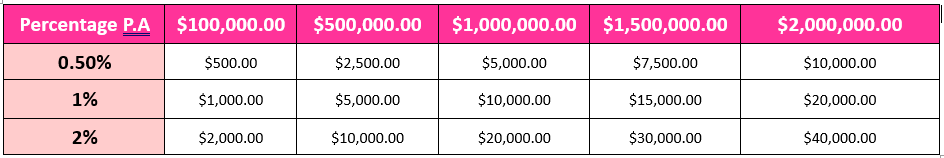

The other method of charging is via a percentage per annum structure. Usually between 0.5% and 2% of ‘Funds under Management’ or FUM to look after that client. Therefore the larger the fund, the larger the fee, irrespective of the associated work required.

Why do we charge financial advice fees this way?

That is the question…

The reason we charge a flat financial advice fee is, that it doesn’t matter what the client’s net worth looks like. It is based on the amount of work required to look after them. It also doesn’t incentivise us to move products unnecessarily which may increase the fees received. I am not suggesting that this is a common practice. If there is a consolidation of funds required, it has to be in the client’s best interest to do so, irrespective of charging method.

Keeping financial advice fees simple

In quite a lot of cases, we see clients who have a lot of their funds tied up in their business and property, so paying as a % is not really an option. To us, charging as a flat rate seems like a fairer option for clients. It is more ‘in your face’ as it is a round dollar per annum. It also avoids people who have a larger asset pool paying higher fees if they have less complex needs.

To be clear, I’m not suggesting either method is right or wrong. More to bring attention to the fact that there is a difference which clients need to be aware of.

When a client from another firm decides to use us as their Adviser, our ongoing financial advice fees may be lower, but sometimes they can be higher too. It comes down to what work is required throughout the year in a case by case situation. We are okay with this, so long as it is clear from the outset. Transparency and understanding is key.

Below is a table showing the cost using a % charged based on funds under management. Please note, each adviser has a different way of charging and may have different % that apply to different levels of funds, so this is merely an example:

In a nutshell

I guess the purpose of this blog is to explain how the financial advice fees can be charged and why we have chosen the system we have. We aren’t shy in discussing fees. We are confident in the job we do, the service we provide and value the difference we make to our client’s financial literacy and freedom. It has been a positive investment for so many.

If you know anyone that could benefit from receiving advice, we offer a 1 hour complimentary appointment where we go through these fees. (Aged Care appointments are the only exception and do incur a charge).

So we hope this helps to bring clarity to the topic. If the waters still feel muddy, you know where to find me!