There are a variety of situations where the catch-up concessional super contribution can help a client’s financial situation, some examples are:

- Building superannuation savings for retirement

- Managing capital gains tax (CGT) on the disposal of a CGT asset (ie. an investment property)

- Assisting with personal income tax where there has been a distortion to the normal income. This could be in the form of a redundancy payout or a work bonus.

Client Example

THE SCENARIO

Recently we had clients of ours, who as part of their retirement strategy, wished to sell their investment property. The property sale would attract a capital gains element as well. They weren’t sure when to sell and how to manage the proceeds afterwards.

THE SOLUTION

The investment property sold for $1,300,000. Based on the date of sale and purchase price, the capital gains tax payable was $222,088 with no super contribution. By using some of the catch-up concessional contribution cap (as the eligibility criteria had been met) the capital gains tax payable (including the tax within the super fund) dropped to $123,485. This resulted in the client saving approximately $98K which they were able to put towards their retirement instead.

What is a Catch-up Concessional Contribution?

Each financial year you can currently contribute a maximum of $27,500 in pre-tax (concessional) super contributions. This is provided you meet eligibility criteria. This is increasing to $30,000 from the 24/25 financial year. It is important to note, this cap includes salary sacrifice contributions and super guarantee contributions (SG) from your employer. A reminder, the SG contributions increase to 11.5% from the 24/25 financial year.

If you don’t use that total cap, then you have the opportunity to use it in future years or unlock past unused amounts for the last 5 years. This is a catch up concessional contribution.. You must meet eligibility criteria here as well. The cap for the 2018/19 financial year can not be used after 01.07.2024.

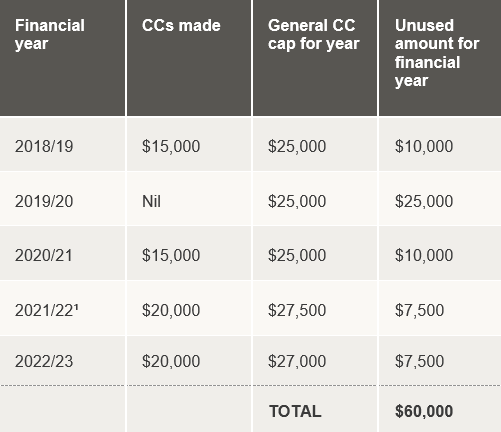

Concessional Contributions 5 Year History Example

In the scenario below, for the 2023/2024 financial year, the client can contribute the full $27,500 concessional cap plus an additional $60,000 in catch up concessional super contributions that have been accumulating over the previous five years. This brings the total to to $87,500. This can create significant tax savings for the current financial year.

Eligibility Criteria for Super Contributions

- Clients Total Super Balance (TSB) as per the ATO’s records needs to be less than $500,000 as of June 30 in the financial year immediately before the year of the contribution. For example – if on 30.06.2023 the balance is $450K, the catch up super contribution can be made in the 23/24 financial year. If the balance is $550K as of 30.06.2024, they are NOT eligible for the 24/25 financial year.

- After age 67, a work test of 40 hours within a 30 day period during the financial year needs to be met PRIOR to making the contribution. This applies up until the age of 74.

- After age 75, client is no longer eligible to make this super contribution

It is important to note, that this is a specialist area that requires Financial Planning AND Accountancy Advice combined. Take diligent care in ensuring this is the right strategy for you. If you think your situation could possibly benefit from these types of contributions, please get in touch with us.

A few additional resources of information you might enjoying reading are: