To be ‘exempt’ or NOT to be ‘exempt’. That is the million-dollar question when it comes to Centrelink and the treatment of assets. Given that the Age Pension is due for its September indexation increase, let’s refresh on assets. So…what assets DON’T Centrelink treat as assessable in the calculation of your Age Pension? Great question, let’s dive into it below…

This doesn’t cover everything. Don’t forget there is also an ‘Income Test’. I have just cherry picked a few big ticket exemptions from an asset test perspective. If you feel like some further reading on the specific points below refer to this link

1. THE PRINCIPAL RESIDENCE

Also known as the home you live in. This is a biggie. If your block is smaller than 2 hectares in size, then it is (usually) exempt – irrespective of the value. Different rules can apply if you sell or move out of this home.

If your block is larger than 2 hectares, then the curtilage is generally assessed. Curtilage being any area over and above the 2 hectare allowance your residence sits on. (Fun word right?) This can impact your payment. Are you a city slicker wanting to go bush for retirement? You may wish to seek advice if the property you are purchasing is more than 2 hectares.

Now, the above is riddled with terms, conditions and what ifs. There are also some important exemptions to note that impact rural customers and primary producers. So, if you are not sure about how you will be impacted, best to call Services Australia or seek advice.

2. RENOVATIONS TO THE PRINCIPAL RESIDENCE (PPR)

Typically funds put towards renovations to the family home are exempt.

3. PRE-PAID FUNERALS

There generally isn’t a limit to the amount that the income support recipient may invest in a pre-paid funeral. However, all conditions need to be met.

4. FUNERAL BOND

Up to a cap (currently of $15,000) and needs to meet terms and conditions.

5. BURIAL PLOTS

This is a specific spot or a right to a place at a general location (cemetery). It is not assessed regardless of value.

6. RAD’S for Aged Care

Amounts contributed towards the accommodation by way of a refundable deposit are generally exempt.

7. CHILDREN RETURNING HOME

Another topic that is increasing in relevance at the moment, is the Granny Flat concept. But in reverse – maybe I should call it the ‘Kiddie Flat‘. This is a situation where adult children are coming back to roost at their ‘parents’ principal residence. Typically due to issues such as; relationship breakdowns, cost of living and the rental/cost of housing crisis etc.

This is a very involved area that needs specialist advice – covering the Estate Planning, Taxation and Financial Advice implications. Looking at this through a Centrelink lens – there are some specific rules around exemptions. These may apply for ‘near relatives’ and dual occupancy of a property.

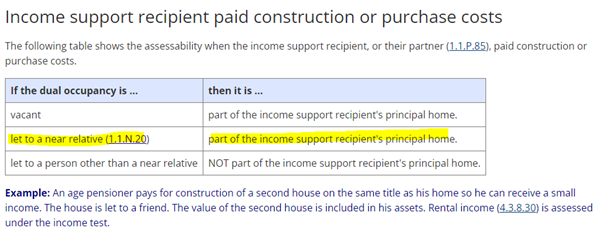

If you, as the pensioner, has helped chip in for some construction costs for your adult child (near relative) to move back into your principal place of residence, then the costs are usually exempt. See table below and link for more information. Also, the area occupied by your child where rent/board is paid, is not typically counted as income – given the ‘near relative’ relationship.

Further information can be found as follows. I would also like to re-iterate that the above is not advice and should not be relied or acted upon. It is imperative to receive personal advice, tailored to your situation, when exploring the above.

4.6.3.50 Assessing Dual Occupancy Homes

1.1.N.20 – Near Relative

4.3.8.40 – Income From Boarders or Lodgers

We hope that helps to give your own situation the once over in your head or plants a seed with regards to any future decisions you might be thinking of making. As always – when in doubt, ask! Quite often ‘surprises’ are overrated when it comes to Centrelink. Best to remain as informed as you can at all times.

And happy Springtime! Bring on the Jacarandas…